The gender wage gap, motherhood penalty, and lower credit scores can hinder retirement wealth building, shows Professor Olivia S. Mitchell in recent MarketWatch piece. Despite these obstacles, women can enhance their financial paths.…Read More

The gender wage gap, motherhood penalty, and lower credit scores can hinder retirement wealth building, shows Professor Olivia S. Mitchell in recent MarketWatch piece. Despite these obstacles, women can enhance their financial paths.…Read More

Workplace changes, economic shifts, technological advances, evolving family dynamics, and the aging population are among the megatrends reshaping work, retirement, and financial security, explains Anna Rappaport of the Society of Actuaries, via the RetireSecure blog. …Read More

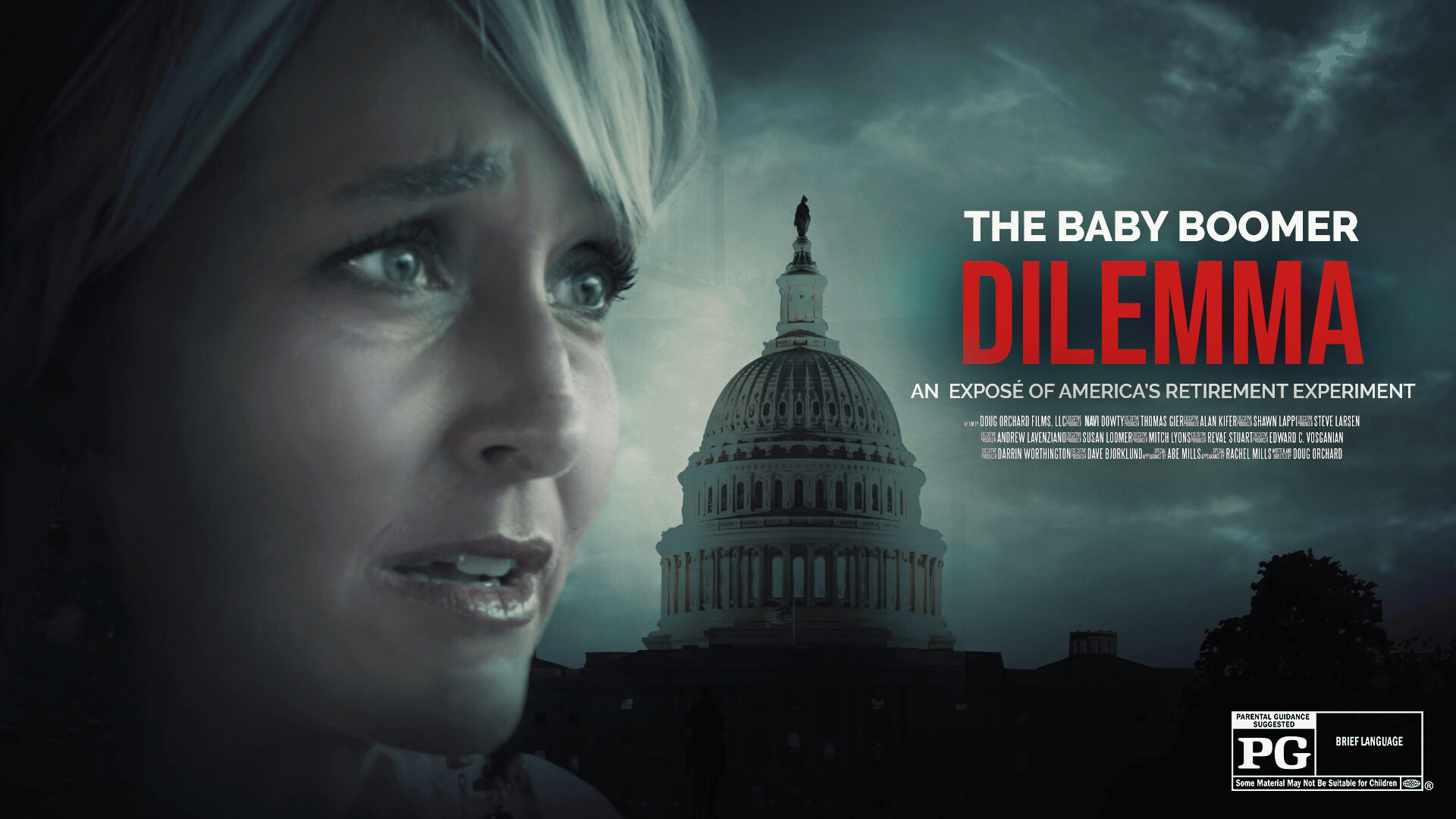

Now available for streaming: The Baby Boomer Dilemma, a documentary examining the American retirement system and issues facing Baby Boomers, features experts including Wharton’s Prof. Olivia S. Mitchell https://www.boomermovie.com/ …Read More

Societal risks such as climate change, pandemics, and financial volatility can have long-term effects and challenge retirement planning and financial resilience, writes Anna M. Rappaport at the RetireSecure blog.…Read More

Black and Hispanic women face greater economic challenges than white women in both good times and bad, according to new research by Wharton Prof. Olivia S. Mitchell, Prof. Robert Clark of North Carolina State University, and Prof. Annamaria Lusardi and Hallie Davis of George Washington University. Via Pensions & Investments.…Read More

Maintaining and using a separate emergency savings account helps make households financially stronger and better able to save more for retirement, writes David John via the RetireSecure blog.…Read More

Common wisdom once held that retired boomers could safely withdraw 4% of their savings per year, but now with rising longevity and healthcare costs, and low returns, that’s too risky, says Wharton Prof. Olivia S. Mitchell via the Christian Science Monitor.…Read More

Millennial and Gen Z adults lagged behind in retirement savings even before the pandemic, but after the past year’s economic hardships, many are now more committed to putting their finances in order, writes Jeanne de Cervens at the RetireSecure blog.…Read More

The TIAA Institute invites you to submit an entry for the 2020 TIAA Paul A. Samuelson Award for Outstanding Scholarly Writing on Lifelong Financial Security.…Read More

Is Social Security a wealth equalizer? John Sabelhaus’ RetireSecure blog notes that including Social Security in household assets boosts wealth levels but doesn’t alter growing wealth inequality.…Read More