By: Anne Lester and Daniel Oldroyd

Anne Lester is Portfolio Manager and Head of Retirement Solutions and Daniel Oldroyd is Portfolio Manager and Head of Target Date Strategies; both are at J.P. Morgan Asset Management.

Though many retirement savers will be pleased with their retirement plan 2017 investment results, the outlook for market returns over the next 10-15 years remains less than inspiring.

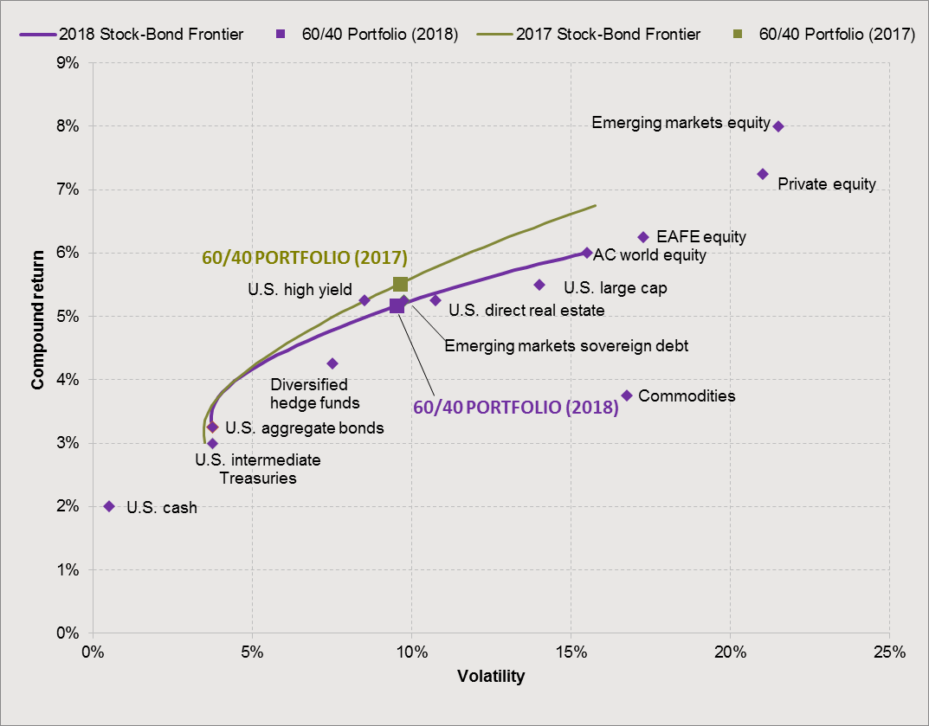

That’s a key message from the latest edition of our new study, Long-Term Capital Market Assumptions. Global economic growth estimates remain modest, and return assumptions for many major asset classes are lower than last year’s. Specifically, the expected return for a simple 60% world equity/40% U.S. aggregate bond portfolio has declined to 5.25%, down from 5.50%, as depicted in the figure below:

US Dollar Investment Frontiers and 60/40 Stock-Bond Portfolios: Comparison of 2017 versus 2018 Expected Risk-Return Frontiers. Source: J.P. Morgan Asset Management estimates as of September 30, 2016 and September 30, 2017.

What Can Plan Sponsors Do?

Without question, retirement plan participants face increased challenges as they work to ensure a financially secure retirement. Of course, plan sponsors and their advisors/consultants cannot control the markets, but there are three practical steps that can help enhance participants’ retirement outcomes across all market environments.

- Encourage more savings. One of the best ways to enhance retirement outcomes is to boost saving, so participants need to start earlier and save more. A good step in that direction is to engage participants using plan design options including automatic enrollment and automatic contribution escalation.

- Make portfolio diversification Though return estimates are down for a simple 60%/40% stock/bond portfolio, several asset classes cluster close to, or even lie above the stock/bond frontier in the Figure above.

This means there is opportunity for diversification and potential return enhancement. For example, a gradually weakening U.S. dollar over the longer term can mean that US investors may benefit from international diversification. Credit remains the bright spot in fixed income, so our long-term projections of credit spreads, defaults, and recovery rates imply a reasonable return boost above government bonds. They also provide a reason to diversify beyond a purely-U.S. bond portfolio.

An appealing way for retirement plan participants to gain to diversified mix of investment options is through professionally-managed portfolio strategies such as target date funds (TDFs). Of course, not all TDFs are created equal! Most importantly, the TDF menu must be well-diversified and constructed by skilled asset allocation professionals who understand how participant behavior and investment needs vary over the life cycle. Additionally, TDF managers must rely on well-informed long-term asset class return, risk, and correlation estimates to inform portfolio construction and management.

- Employ more active management. Savvy plan sponsors recognize that there are two components of return: the portion due to the market itself (beta), and the portion resulting from active manager skill (alpha).

Given the lower outlook for beta returns across most asset classes, alpha becomes even more critical for achieving attractive returns. Skilled professional investors can generate alpha through adept security selection and/or tactical asset allocation. For example, insights into tangible investment opportunities associated with technological change and the ability to tactically position portfolios through the late-cycle challenges ahead present numerous opportunities for alpha generation. Given the low correlation between the alpha and beta components of return, the active component can also help to diversify portfolio risk.

The Takeaway

Naturally plan sponsors (and retirement savers!) should consult with their financial professionals before revisiting retirement plan investment portfolios. Yet these three simple steps – saving more, diversifying better, and looking to active managers – especially for international equities — could open the door to new opportunities.

This piece was originally posted on February 16, 2018, on the Pension Research Council’s curated Forbes blog. To view the original posting, click here.

Views of our Guest Bloggers are theirs alone, and not of the Pension Research Council, the Wharton School, or the University of Pennsylvania.