Abigail Hurwitz is an Assistant Professor in the Robert H. Smith Faculty of Agriculture, Food, and Environment of The Hebrew University of Jerusalem.

Olivia S. Mitchell is the International Foundation of Employee Benefit Plans Professor, as well as Professor of Insurance/Risk Management and Business Economics/Policy; Executive Director of the Pension Research Council; and Director of the Boettner Center on Pensions and Retirement Research at the Wharton School of the University of Pennsylvania.

Orly Sade is the Albertson-Waltuch Chair in Business Administration and an Associate Professor of Finance in the Department of Finance, School of Business Administration, Hebrew University of Jerusalem.

Understanding how individuals perceive and use their chances of living a long time to make retirement decisions is important for households, researchers, and policymakers. Specifically, to plan for retirement, people need to understand how long they will survive and make informed decisions about how quickly to draw down their savings in retirement, when to claim their Social Security and pension benefits, and whether to purchase annuities to avoid outliving their assets. Nevertheless, these are not simple decisions for many, due to low financial literacy and cognitive shortcomings, behavioral biases, and limited attention.

Our Analysis

In our recent paper, we devised and fielded an online experimental survey to measure how people assess their own life expectancies – the average number of life years remaining – and longevity risk – the chance of living to a very old age. Next, we assess alternative ways to boost peoples’ awareness of longevity risk to see if this influences their financial decision-making. Specifically, we randomly assigned to study participants alternative vignettes that permitted us to experimentally test how to frame survival probabilities, so we can evaluate which presentations boosted people’s understanding of their chances of living a very long time. If a substantial portion of the population incorrectly estimates its life expectancy when making financial decisions, or ignores such information, providing more salient evidence about life expectancy and longevity risk could enhance retirement security and affect resources available for the elderly.

We started with an exploration of how people evaluate their own subjective life expectancy and longevity risk, which we then compare to objective measures from sex/age life tables for the general population. Next, we use our vignettes to test alternative ways to frame survival probabilities in the online experiment, which allows us to evaluate which presentation enhances people’s understanding of their chances of living a very long time. Accordingly, our work can inform insurers and policymakers on how to encourage people to annuitize and make other financial decisions relevant for later life.

Results

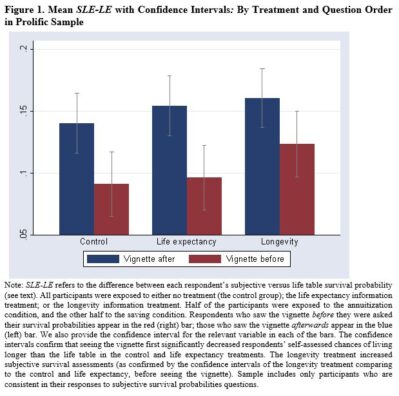

Our findings show, first, that simply asking participants to think about life cycle financial decisions can significantly narrow the gap between subjective and objective survival probabilities, across all life expectancy and longevity interventions. We further find that providing people about their likely longevity does change their perceptions about living a long time, while providing life expectancy information has no effect. This effect is most significant for people who have some understanding of survival distributions. Accordingly, we conclude that people tend to have a good idea of their average survival chances, but they are under-informed about the right tail of the survival distribution.

Finally, we discover that providing such information to participants also changes how people think about annuitization decisions. In particular, explaining longevity risk can enhance peoples’ interest in longevity insurance, by which we mean income annuities.

Conclusions

Good financial retirement decision-making requires people to have a well-informed notion of their life expectancy and longevity risk so they can save, invest, decumulate sensibly, and avoid running out of money in old age. Yet many open questions remain about what people understand about these important factors, and whether providing information about survival risks makes a difference to their decision-making processes. Our survey shows that many individuals correctly estimate their own survival probabilities but providing them with information about longevity can improve their decision-making.

This subject is important for researchers and policymakers, as well as those concerned about when and how people save for, and then withdraw from, retirement accounts. For instance, if a substantial portion of the population incorrectly estimates life expectancy when making financial decisions or ignores such information when provided, it might be feasible to promote better financial decision-making by rendering this information more salient. In addition, individuals can be educated or informed about longevity risk when they make important saving and decumulation decisions, so as to better manage their chances of running out of money in later life.

Views of our Guest Bloggers are theirs alone, and not of the Pension Research Council, the Wharton School, or the University of Pennsylvania.