Gal Wettstein and Karolos Arapakis are research economists at the Center for Retirement Research at Boston College. Wettstein conducts research on labor market outcomes for older workers, health insurance markets and coverage, retirement decisions, and savings. Arapakis’ research interests include public, health, and computational economics.

Over the past five decades, researchers have suggested multiple explanations for the “annuity puzzle,” or why annuity demand is far below what economic models predict. Of these rationales, ‘irrational’ survival pessimism is particularly appealing. By being pessimistic about their future survival probabilities, individuals underestimate the future payouts from an annuity. Hence, they might believe that annuities are less attractive than they really are.

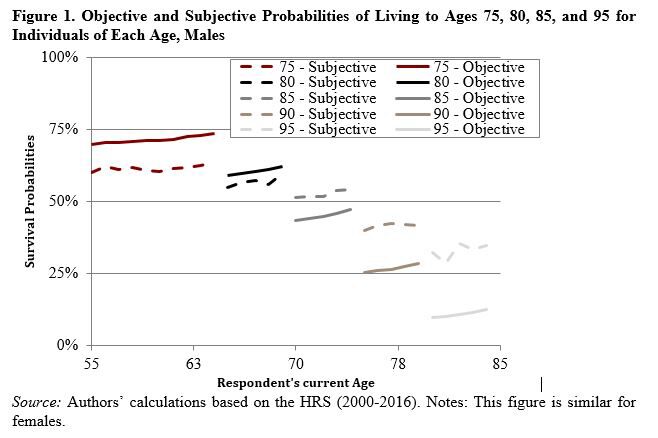

Our research using the nationally representative Health and Retirement Study (HRS) shows that people are, indeed, pessimistic about their survival just when they would be making irreversible annuitization decisions. This pessimism is evident in Figure 1 (above), which shows that, throughout their 60s, peoples’ subjective assessment of the chance of living to some older age – the dashed lines – are below their objective chances reported in life tables – the solid lines.

Accordingly, it is reasonable to expect a link between subjective survival pessimism and annuity demand. The question is whether such a relationship shows up in the data. Our recent study examined the relative importance of objective life expectancy and subjective survival pessimism for annuitization.

Objective Life Expectancy and Subjective Survival Pessimism

Our research focused on persons age 55-64 in the HRS. First we construct a measure of objective life expectancy as well as a measure of subjective survival pessimism, defined as the difference between each person’s objective and subjective life expectancy. . Subjective life expectancy was calculated using the HRS expectations module, which asked participants: “What is the percent chance that you will live to be age [X] or more?”

Next, we derived peoples’ objective life expectancies using life tables that differ by birth year, age, race, gender, and educational level.

How do these measures affect annuitization?

With these measures in hand, we then inquired whether peoples’ annuity purchases were better explained by their objective or their subjective survival assessments. Specifically, we asked whether there is a significant incremental effect of subjective survival pessimism after holding objective life expectancy constant.

The evidence showed that both objective life expectancy and subjective survival pessimism were associated with buying annuities, yet objective life expectancy accounted for more than did their subjective pessimism. Specifically, a one-year increase in objective life expectancy raised the chance that people receive income from a commercial annuity by 0.13 percentage points. By contrast, a one-year decline in pessimism raised the chance of people having annuity income by only 0.02 percentage points.

What this means

Both annuity providers and policymakers would benefit from a better understanding of what drives annuitization. Given our finding that annuitization is based mainly on objective survival measures, we suggest that more education about life expectancy would have little impact. At the same time, educating people about their subjective probabilities of living to older ages could help motivate annuitization. These subjective probabilities might matter, as they reflect peoples’ subjective assessments of living to very old ages. This is precisely where having lifetime income becomes important, as people exhaust their other financial resources.

Additionally, recent research has demonstrated that informing individuals about their chances of living a very long time can substantially change their perceptions about longevity. Accordingly, our research suggests that financial planners would do well to educate their clients about the chances of living a long time, rather than simply using their life expectancies to calculate retirement saving and spending needs.

Views of our Guest Bloggers are theirs alone, and not of the Pension Research Council, the Wharton School, or the University of Pennsylvania.